Preserving Wealth in Africa

by Subomi Plumptre

Africa is a great place to make money.

First, there’s the sheer size of our consumer market. (Nigeria alone has 200 million souls.) So, if you have an essential product – food and utilities for instance – Africa is a thriving bazaar. According to the African Development Bank, our middle class has tripled in the last 30 years to about 170 million, thus also paving the way for the sale of non-utilitarian products.

We may be years behind the world on social, economic, political, human and infrastructural indices. But, this developmental gap is a huge market for products that have already reached their peak in other regions. For example, when GSM was introduced, mobile phone makers discovered new profits in Africa. The same goes for services where specialized knowledge is required, that has not yet been home-grown. Nuclear energy, for instance.

So, it’s clear you can make a lot of money in Africa.

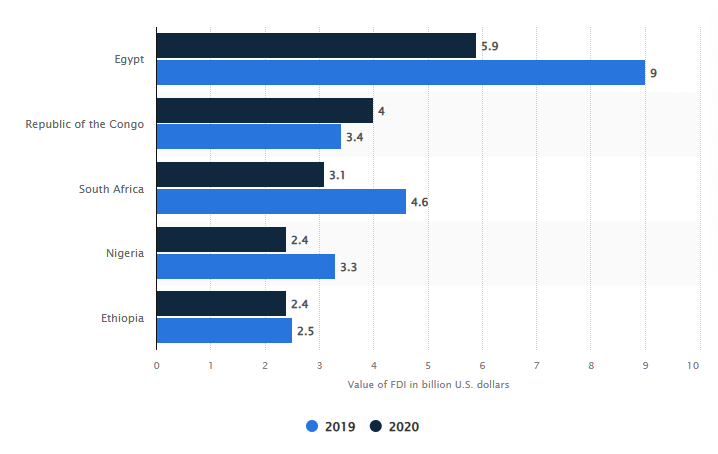

However, many investors are increasingly choosy about where in Africa, their Foreign Direct Investment (FDI) goes. This is because unless you’re an entrepreneur with a light conscience or missionary complex, you will be troubled doing business in some African countries. Here are some of the things that may shock you – unpredictable & vindictive policy changes, poor human resource quality, values erosion and unsophisticated institutions and infrastructure. These things take an incredible will to fix and require commitment from governments & citizens. In most cases, lack of funding is not what prevents the fix. It is political complexity, human ego and personal interest.

Take Nigeria for instance. While we are quick to tout FDI, we are less hasty to speak about opportunity cost. That is, the volume of FDI that should go to us (based on our relative market size) that finds its way to other African countries instead. Those finished products often get exported back to us and the profits repatriated. If we are not careful, at a strategic level, we will become more of a sales destination, than an investment destination. Even our extractive industries will be invested in simply meeting another country’s mineral needs quota.

Some of the most innovative products being introduced to Africa by Africans, say Fintech, have their IP domiciled elsewhere. Even the brain trust behind those products lives elsewhere (or the managers have dual citizenship) just in case. Which brings me to another point.

Africa is a great place to make money but oftentimes is not a safe place to preserve that wealth.

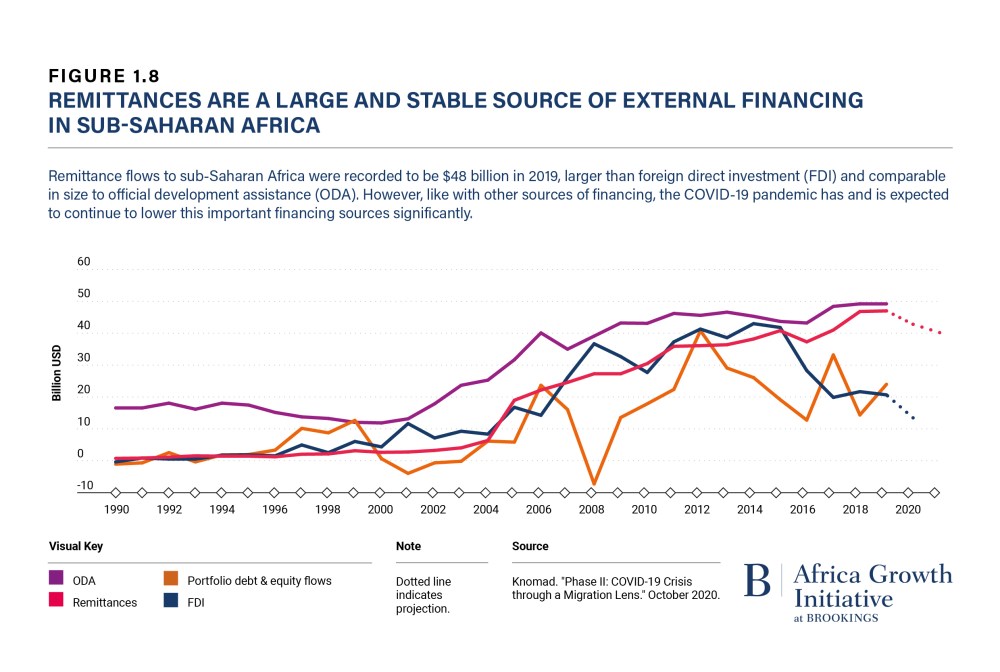

This needs to change if we are to build domestic financial capacity. So many professionals and businesses don’t mind paying taxes on their income. In fact, many companies will deduct from source on behalf of their employees. But, after that, those individuals invest in cryptocurrency and other USD instruments to preserve the value of their excess income. This is money that could go into venture funding, the stock market and other assets back home. Rather, it leaves.

No one wants to wake up to realize they can no longer easily move funds in their domiciliary account. Nor do they want their land reclaimed in a government dispute. They fear a venture-funded company dying suddenly because of a surprise policy. They are concerned about being tied up in court for months over legitimate debt claims.

A state-funded business entity from Asia can afford the risks of entrepreneurship in Africa. Even a USD-rich global brand can. But many other businesses cannot. So, they look to other markets.

If you’re not avaricious and you value peace, you prefer to make $1 million in a relatively small market like Rwanda than $50 million with high blood pressure in other African nations.

Remittance-based income may also be affected in the years to come. This is because it is far easier and cheaper to send money home via peer-to-peer crypto exchanges than by bank SWIFT networks.

Now, let’s talk more about preserving wealth.

The least risky investment instruments are often sovereign bills and bonds. That means, you must really trust the country’s fiscal policies and the stability of its currency to invest. When you don’t, you prefer taking those funds elsewhere. You don’t want touching stories about devaluation when it’s time to pay your kid’s college tuition 18 years later.

Although I have investments in other regions, I have significant holdings in Africa too. This does not come from a place of investment sense, as those assets are seemingly depreciating daily, relative to the Dollar. But, it comes from a desire to have skin in the game and a real stake in the continent of my birth. It stems from a longing to be part of the solution and to provide some thrust to ideas and innovations in Africa.

But I repeat, unless you have a light conscience, you have found a quiet place to make money away from the prying eyes of regulators, or you have extensive political networks, Africa will be a difficult market to navigate. Ultimately, everything rises and falls on politics and policies here. Therefore, businesses need to pay attention to those things or pay someone on their team who will.

For more, please read Investing in Nigeria.

[bctt tweet=”Africa is a great place to make money but oftentimes, it is not a safe place to preserve that wealth. This needs to change if we are to build domestic financial capacity.” username=”@subomiplumptre”]