How to Build Wealth Step-by-Step

by Subomi Plumptre

In this article, I will share a framework for building wealth, no matter your stage of life.

Before we begin, understand that your knowledge level and net worth determine your investment strategy.

If you want general knowledge about investing, take my free investment course. I’ve listed some resources at the end of this article.

Regarding net worth, you cannot invest your way out of poverty. Investing assumes you already have disposable income. Additionally, some investments require access that only significant capital can provide.

Now, let’s begin.

First, Shift Your Wealth Mindset

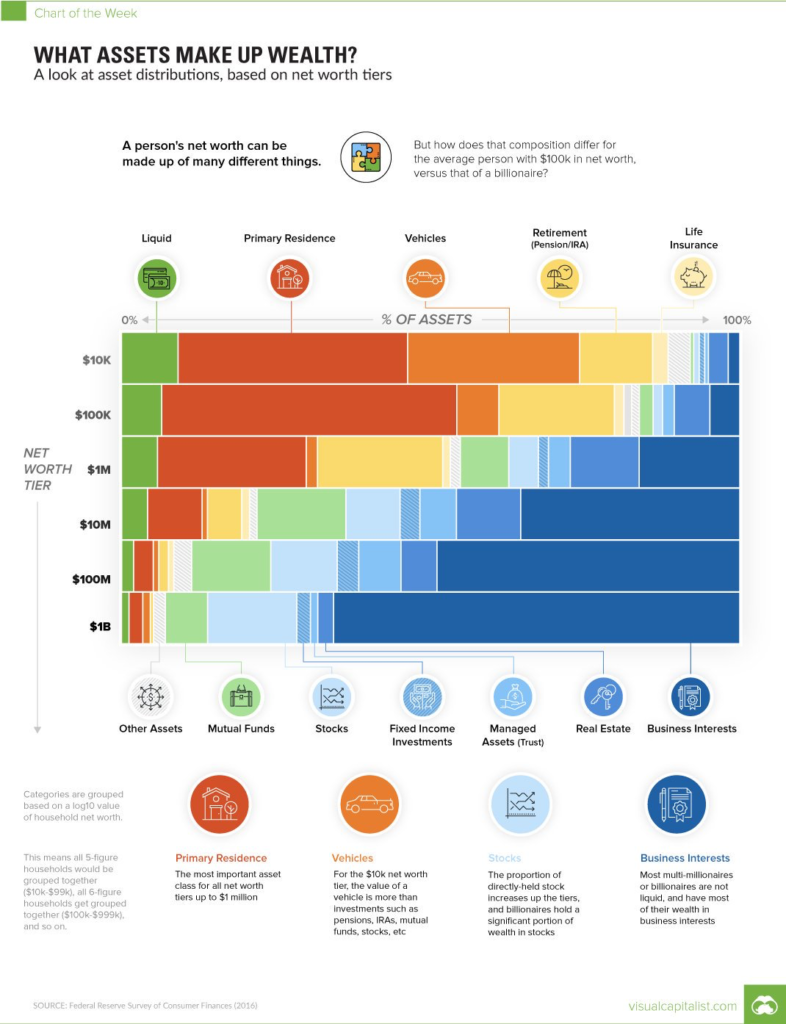

Study this image on how people at different net worth levels build wealth. It will help you rethink wealth structuring as you grow financially.

One key insight: on the lowest rung of the wealth ladder, people prioritize buying a primary residence and depreciating assets like cars.

On the middle rung, there’s a shift to tax-advantaged assets like pensions and life insurance, as financial freedom becomes a goal. Real estate transitions into an investment vehicle rather than just a home.

On the highest rung, stocks and business interests dominate—where other people generate income for you while you sleep.

Building Wealth in 5 Steps

How do you move from one step to the next? Let’s discuss.

Step 1: Income

At this stage, you exchange time for money.

Any activity that requires your time qualifies as a source of investable income—jobs, businesses, day trading, property flips, etc. As long as your time and presence are required, you are still at stage one.

Prioritize paying yourself first. Invest at least 20% or more of your income every month. It’s a time of delayed gratification, and consistency is key.

The next step tells you what to invest in.

Step 2: FIRE

The FIRE movement (Financial Independence, Retire Early) redefines retirement as financial independence.

You don’t need to wait until 60 years old to untether from a job. The goal is for your investments to generate enough income to cover your daily needs, allowing you to retire early and live freely.

Once you start investing, focus on earning consistent returns that eventually match (or exceed) your monthly salary.

A word of caution: Don’t take excessive risks, especially if you’re an entrepreneur. Running a business is already risky—don’t double your exposure.

Until you’re financially free, most of your investments should be in licensed and regulated funds. Safety and credibility are essential.

To be specific:

Leverage tax-efficient vehicles like pensions and life insurance.

Prioritize high-growth fixed-income funds and listed ETFs. While mutual funds offer savings flexibility, long-term fixed-income funds yield higher returns.

Take investment risks based on your age. The older you are, the less time you have to achieve financial freedom. The younger you are, the more risk tolerance you have.

If you must take risks, reinvest profits from high-risk assets into low-risk investments.

Compound your investment annually—roll over both principal and returns.

With consistency, and depending on the percentage of income you invest, you could reach financial independence within 10 years.

Step 3: Assets & Angels

As you achieve financial freedom, store wealth in appreciating assets like real estate, art, and collectibles.

At this stage, people will approach you for joint ventures or angel investments.

Two crucial pieces of advice:

- Collaterize your joint ventures. Your risky days are over—you can’t afford to lose retirement funds.

- Leverage assets for cash that you can reinvest. Don’t sit on dead assets.

I can teach you how to do both.

Step 4: Private Equity

The zenith of wealth is having a 𝗳𝗮𝗺𝗶𝗹𝘆 𝗼𝗳𝗳𝗶𝗰𝗲 with a strong investment team and experienced managers.

Your team will:

- Manage and grow your investment portfolio.

- Buy franchises and take business stakes on your behalf.

- Run your companies.

This is the stage where money works for you while you sleep.

Step 5: Trusts

As you acquire assets & businesses and plan your legacy, all your interests should be placed in Trusts (in a competent legal jurisdiction).

This drastically reduces tax liabilities, ensuring you live off dividends and business assets for the rest of your life.

These are the foundational steps to building wealth. Here are some recommended resources:

- The Richest Man in Babylon – George S. Clason

- A-List Angels – Zack O’Malley Greenburg

- Inside the Investments of Warren Buffett – Yefei Lu

Additional Resources:

You cannot invest your way out of poverty. Investing assumes you already have disposable income.

Share on X

For more, read Four Thoughts on Investment